Day trading has become a common strategy in financial markets. It permits traders to profit from short-term fluctuations in price. For those who use Ninjatrader, having the right tools could make a significant difference in the success of trading. This article will cover the most important aspects of Ninjatrader day trading strategies, indicators, signals and systems. It also provides an extensive guide for new and experienced traders.

Understanding Ninjatrader Day Trading Indicators

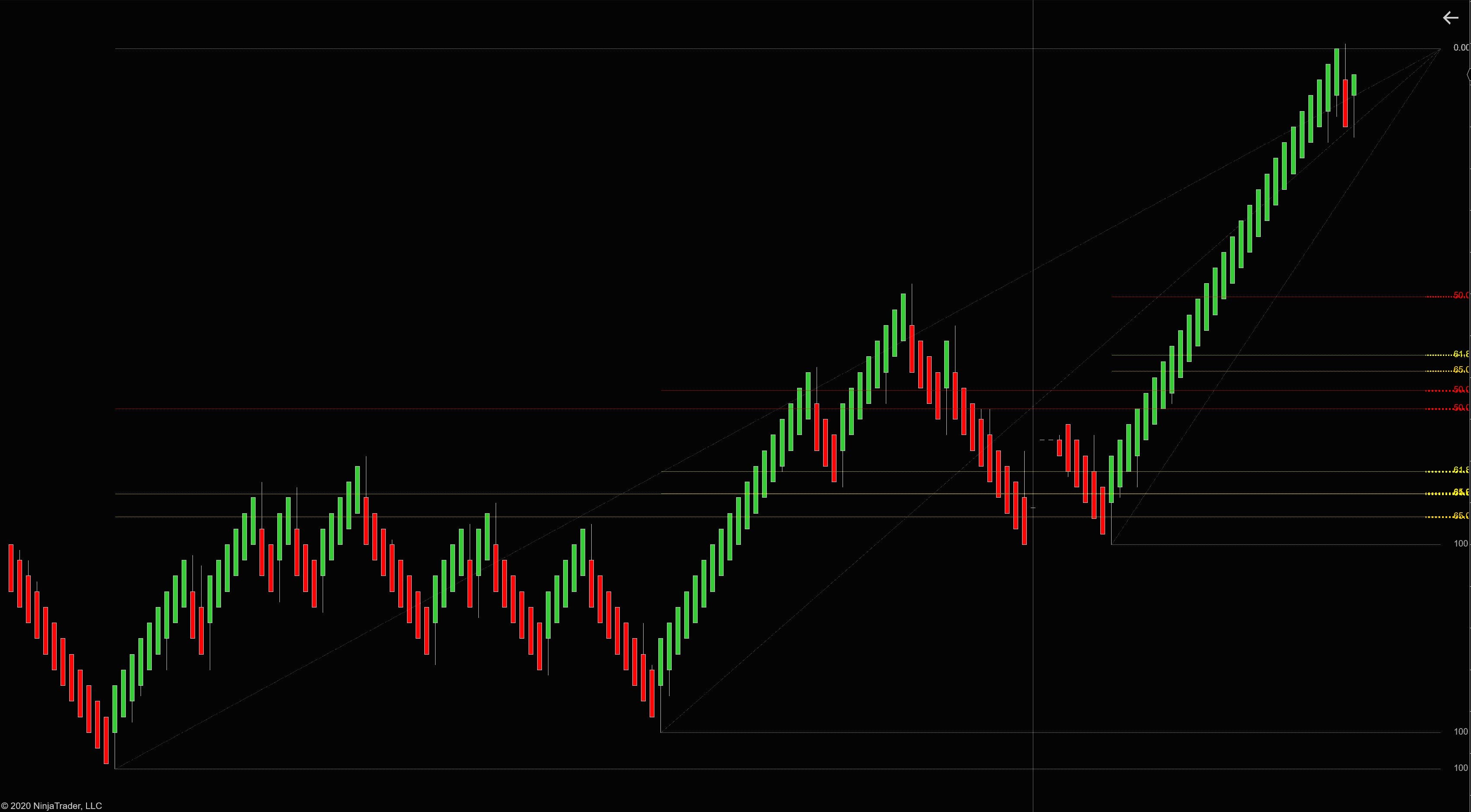

Ninjatrader Day Trading Indicators are crucial instruments for traders to analyse data and make informed trading decision. They are based on different types of data including volume, price and time. Indicators such as Bollinger Bands (Bollinger Averages) and the relative Strength Index (RSI) are extremely popular. The traders can utilize these indicators to detect trends, gauge the degree of volatility, as well as determine the best entry and exit points.

For new traders it is essential to begin with the most reliable indicators in order to ensure that you don’t get overwhelmed with information. Moving averages can be a good beginning point because they smooth out price data and help to highlight trends across time. As traders gain experience as they gain experience, they’ll be able to incorporate more indicators in their analysis.

The importance of Day Trading Signals from Ninjatrader

Ninjatrader day trading signals are generated based on predefined criteria set by the trader. The signals alert traders to the possibility of buying or selling opportunities on the market. The signals can be built around one indicator or on a combination of indicators of indicators, providing a greater depth analysis of the market.

Ninjatrader is able to create a trading signal that is automated. Automating trading signals can eliminate emotional bias and ensure that trades are executed based on objective criteria. Backtesting signals using data from the past lets traders evaluate their effectiveness prior to implementing them in live trading.

Crafting Effective Ninjatrader Day Trading Strategies

Successful trading requires a well-constructed strategy. Ninjatrader day trading strategies differ from simple to complex dependent on the experience of the trader and their risk tolerance. A common strategy is to use moving averages to recognize trends, and also to use a stop-loss to control the risk. Advanced strategies can include multiple indicators and complex rules for entry and exit as well as automated execution of trades.

It is essential to be aware of market conditions and the objectives of the trader when creating strategies for day trading. Strategies must be able to adapt to changing market conditions. Because what works in a trending market may not be effective in a range bound market. Retrospectively reviewing and updating strategies will help them remain effective as time passes.

Building Robust Ninjatrader Day Trading Systems

Ninjatrader is an online trading platform that integrates signals and indicators into a coherent framework. These systems can be either manual and rely on the trader to make trades based on signals, or completely automated, where the software manages all aspects of trading.

Automated trading comes with a variety of advantages, such as greater efficiency, less emotional trading, and the ability to rigorously test back-testing strategies. However, they are also prone to risks such as unanticipated changes in the market, or system-related errors. It is vital for traders to keep an eye on their systems and be prepared to intervene when necessary.

Day Trading: Common challenges and solutions

While day trading is an investment that can be lucrative, it comes with some challenges. The first-time traders are often faced with difficulties because of their unrealistic expectations about trading, reliance on random indicators or emotional decision-making. To overcome these challenges it’s important to be aware of the market and realistic expectations.

The day trading success is dependent on risk management. Risk capital is money traders are able to risk without compromising their financial security. Stop-loss orders, position sizing, and risk management can be used to reduce risks and protect the investment.

The significance of using high-quality trading Tools

For traders who trade on a daily basis, access to high-quality trading tools is vital. IndicatorSmart is one example. It offers top Ninjatrader indicators for day trading as well as signals and systems created to give traders the finest resources. These tools are able to improve market analysis, improve the process of making decisions and result in better trading results.

Conclusion

Ninjatrader offers day traders a powerful platform, with various tools and features that can enhance their trading performance. Ninjatrader indicators are signals, strategies and indicators that can be utilized to create an all-encompassing approach to trading. Day trading success demands constant learning, adaptability and effective resource usage. A well-equipped and shrewd mindset will help traders navigate day trading difficulties and reach their financial goals.